The Royal LePage Home Price Update and Market Forecast was distributed to the media early this morning. The release, distributed each quarter, includes price data and insights from experts in 63 real estate markets across the country, as well as national and regional forecasts. The link is to the full article and I have highlighted key points and Market information for Greater Vancouver in the post.

After a stronger-than-anticipated first quarter, upward pressure on home prices is rising. Previously sidelined homebuyers are rebooting their purchase plans in anticipation of tight competition following an expected easing of interest rates later this year.

First-quarter highlights:

- National aggregate home price expected to rise 9.0% year over year in Q4 of 2024 (up from previous forecast of 5.5%)

- Aggregate home prices in the greater regions of Toronto and Montreal expected to increase 10.0% and 8.5% year over year in Q4 2024, respectively, the highest forecasts of all major regions

- Royal LePage® expects home prices in the Greater Toronto Area will surpass those in Greater Vancouver in 2024

- Among major regions, Calgary recorded highest year-over-year aggregate price appreciation (9.7%) for the second consecutive quarter; increased 1.9% on a quarterly basis

- 89% of regions in the report recorded quarterly price appreciation in the first three months of the year, ahead of the traditionally busy spring market period

Interest rate cuts and mortgage renewals

“Given the strong start to 2024, the cadence of the market for the balance of the year points to a normally busy spring market that will lead into an uncomfortably busy fall. It is clear we are rapidly transitioning away from a buyers’ market and back to an environment where the seller has the upper hand,” noted Soper.

By the end of 2026, almost all mortgages taken out before the Bank of Canada started raising its key lending rate in March of 2022, will have transitioned through a renewal cycle and into an elevated borrowing rate environment.[1]

“Homeowners who took advantage of the historically-low mortgage rates at the beginning of the decade have soberly accepted that their upcoming renewals will mean higher borrowing expenses. We do not see this as a material drag on the housing market. Two years into the post-pandemic period, about half of mortgages have rolled off those record lows, and Canadians continue to meet obligations to their lenders, with the national mortgage default rate remaining at near historic lows. Further, income growth and the period of flat home prices have helped to mitigate the impact of increased mortgage costs. People will go to great lengths to hang onto their homes, so we can expect a pull-back in discretionary spending, including on travel and entertainment,” said Soper.

Forecast

Royal LePage is forecasting that the aggregate price of a home in Canada will increase 9.0 per cent in the fourth quarter of 2024, compared to the same quarter last year. The previous forecast has been revised upward to reflect a stronger-than-expected first quarter.

Nationally, home prices are forecast to see strong price appreciation through the second and third quarters, and taper off in the final months of the year, as is the seasonal norm.

The full article gives Canadian Market Regional Summaries with both Survey Charts and Forecast Chart. Here is the summary for Greater Vancouver.

Greater Vancouver

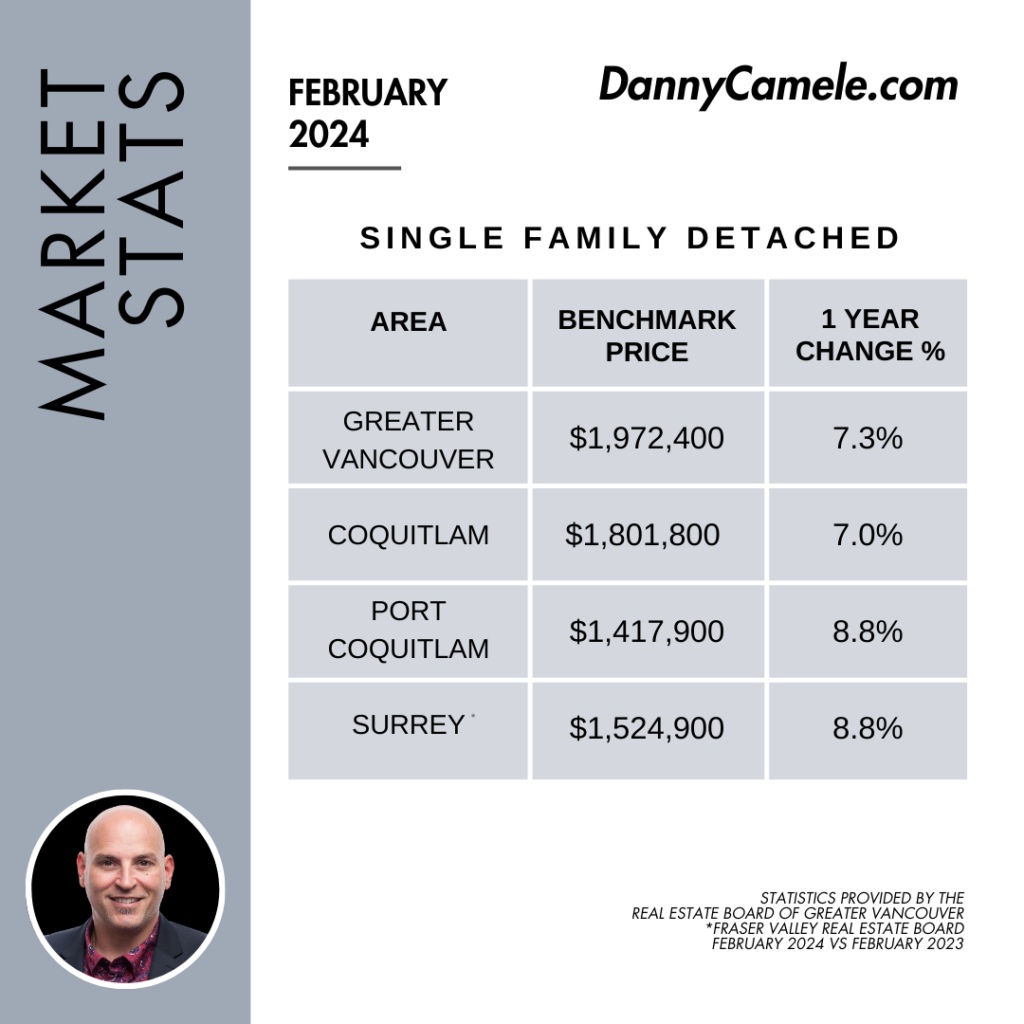

The aggregate price of a home in Greater Vancouver increased 3.4 per cent to $1,238,200 year over year in the first quarter of 2024. On a quarterly basis, the aggregate price of a home in the region increased 1.5 per cent.

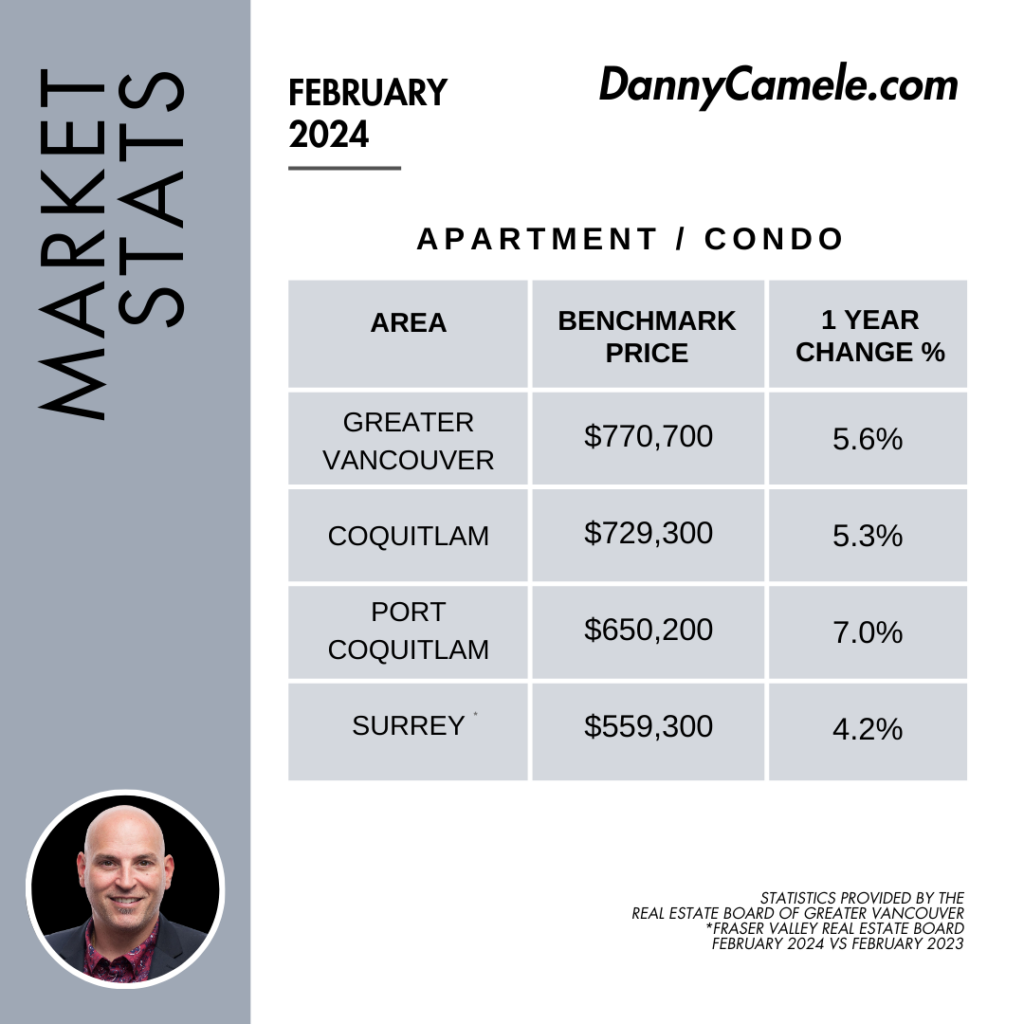

Broken out by housing type, the median price of a single-family detached home increased 5.3 per cent year over year to $1,750,000 in the first quarter of 2024, while the median price of a condominium increased 4.3 per cent to $778,600 during the same period.

“Heading into spring, the Vancouver market has been steadily gaining momentum, though not at the feverish pace that other markets across Canada have seen as of late. Desperately needed housing inventory has been building, pushing the reserve of homes up from 8,000 listings at the beginning of the year to closer to 10,000,” said Randy Ryalls, general manager, Royal LePage Sterling Realty. “We are not in a full on sellers’ market yet, but most housing segments are moving toward a sellers’ market and desirable, well-priced properties are being quickly snapped up, often in multiple-offer scenarios, a sign of pent up demand and that home prices will continue to increase as we head further into the second quarter. Buyers are coming off of the sidelines and are ready to compete.”

Ryalls added that the sentiment among developers remains lukewarm, as builders wait for more certainty on consumer appetite and the state of the Canadian economy before launching additional pre-construction projects. With interest rates anticipated to drop later in the year, development activity is expected to pick up as market conditions improve.

In the city of Vancouver, the aggregate price of a home increased 2.8 per cent year over year to $1,402,400 in the first quarter of 2024. During the same period, the median price of a single-family detached home increased 6.4 per cent to $2,253,300, while the median price of a condominium increased 6.3 per cent to $844,500.

“The gentle upswing in activity we’ve experienced in the first few months of the year is expected to continue throughout the months ahead, likely resulting in a moderate increase to home prices,” said Ryalls. “We predict that many buyers will attempt to enter the market in the near future in anticipation of a surge in demand when interest rates eventually drop.”

Royal LePage is forecasting that the aggregate price of a home in Greater Vancouver will increase 5.5 per cent in the fourth quarter of 2024, compared to the same quarter last year. The previous forecast has been revised upward to reflect a stronger-than-expected first quarter.

Royal LePage House Price Survey Chart: rlp.ca/house-prices-Q1-2024

Royal LePage Forecast Chart: rlp.ca/market-forecast-Q1-2024